This post is not sponsored; all opinions are my own. I may make a small commission on any purchase made through the links in this post at no additional cost to you (and I’d make these recommendations for the best Profit First bank account regardless, because they’re that good).

Let’s set the vibes, right off the bat:

I did not grow up talking about money. It wasn’t “polite.” And so it wasn’t done.

Which means that it wasn’t until my late 20’s that I even sat down and started having honest conversations with myself (and my partner) about my relationship with money, and how confused I was about it all (admit I’m bad at something? No thx I’ll just ignore it forever).

In fact, I felt so confused about money that it stopped me from opening my first business until way after I wanted to, and contributed heavily to my decision to step away from that business later. Saving for quarterly tax payments and figuring out how much I could pay myself seemed too complicated – so I just opted out and watched from the sidelines as other people grew businesses like the one I’d left.

And the reason I’m telling you all of this? I finally found a new lens for looking at business finances that’s not complicated, makes sense, and actually makes me… good at money? ME! Can you even imagine?

(I could not, a few years ago)

So before we dive into the best Profit First bank account, we’re gonna talk about the exact system that made money make sense to me, and changed my business forever.

What is the Profit First method?

In a nutshell, the Profit First method is an approach to accounting that puts the emphasis on building financial wellness through focusing on paying yourself.

Traditional account looks at profits like this:

Sales – Expenses = Profit

The Psychology of Profit First Finances

The Profit first book argues that humans are hardwired to “grow what we focus on,” so in a traditional accounting model that emphasizes expenses – we end up growing our expenses and sales.

Profit First flips that concept on its head, and looks at finances like this:

Sales – Profit = Expenses

Instead of paying yourself what’s “left over,” this framework encourages you to prioritize your profit and paying yourself FIRST, then keeping your expenses within the range of what’s “left over.”

Does Profit First Work? Yes, if your brain likes it!

The Profit First book dives into a detailed look at why the method has psychological benefit – but basically, Profit First leverages human traits & tendencies in order to reframe how we think about money.

Profit First works how our brains do (even if yours is chaotic like mine)

Parkinson’s Law is the idea that work expands or contracts depending on how much time we’ve set aside to do it. Profit First makes the argument that our approach to business expenses is similar – we’re more creative and resourceful if we have a smaller budget for expenses, which stretches that budget and allows for more profit.

Honestly – I’ve found this to be true! I’ve gotten more scrappy with how I can leverage the few subscriptions I maintain to keep expenses at a minimum, and I opt for annual payments for almost everything (distributed throughout the year) since there’s usually a discount for paying upfront.

What are the five Profit First bank accounts?

Now, the real content – here’s how Profit First actually works. Basically, Profit First recommends setting up five business bank accounts (yep, five) so you have “buckets” to sort money into. Here’s a look at the recommended Profit First buckets and how I simplified them for my business.

Income

This account is the one that all of your revenue streams pour into. For example, in my business all of my paid client invoices and template shop revenue sources are connected to my Income account.

Every 1-2 weeks, I open my bank accounts and distribute my income into the other buckets/accounts.

Taxes

This is the account I use to hold money I’m saving for quarterly estimated tax payments. The book walks you through a ton of the methodology for how to pick percentages for all of these buckets, but basically – I pulled from our tax bracket data and set aside a fixed percentage every time I distribute my income.

Profit

This account holds a certain percentage of your income as profit – but I actually use it as more of an emergency/floating fund. This is where I pull from if something breaks (I’ve had to replace both my laptop and iPad in the last year!), or if I find a conference or webinar I want to join.

Owner’s Comp

The Owner’s Compensation account is where you pay yourself from – I have it directly connected to personal checking + savings accounts and opt to pay myself every 2 weeks or so! Because my partner has a job with fixed biweekly paychecks, I pay myself on the weeks he doesn’t get paid so we have income each week (just personal preference!).

Operating Expenses (OPEX)

The OpEx account is for paying out expenses – I have my business debit card attached to this account and it’s where all of my recurring payments and subscriptions are pulled from, as well as compensation for my virtual assistant and independent contractors.

I keep a Notion dashboard that helps track all of my monthly, quarterly, and annual expenses so I can always ensure there’s enough in this account!

The Best Profit First Bank Account

I’ve actually tried similar systems like Profit First for YEARS, and could never make them work – until I had a bank account that actually reflected the “buckets” I was using. *Somewhat shockingly,* I’m not one to keep track of things in a meticulous spreadsheet – so just tracking how much was in each “bucket” was NOT THE VIBES for my brain.

I needed a bank account that actually showed me the different buckets, made it easy to move money between them, didn’t penalize me for draining them (I empty the income bucket into all of the other ones twice a month), and was generally friendly to use.

Enter: Relay.

Relay Financial is a money management platform that makes it legitimately easy to deal with my finances.

EASY. For ME. A “struggles with finances girlie” for 30+ years.

Relay is a financial technology company, not a bank. Banking services and FDIC insurance are provided through Thread Bank, Member FDIC. The Relay Visa® Debit Card is issued by Thread Bank pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa® debit cards are accepted.

My Profit First Bank Account Setup

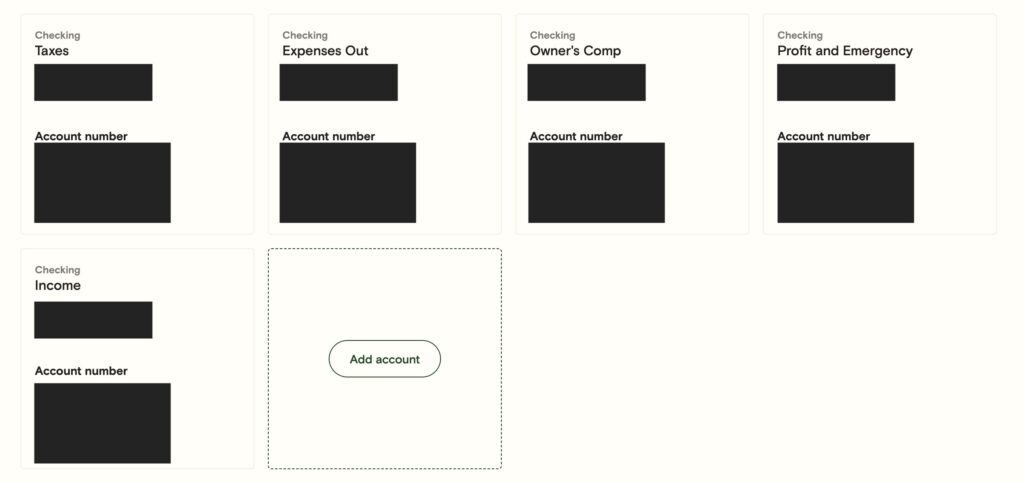

Because I’m nosy and love a behind-the-scenes moment into the intimate details of businesses – here’s my actual banking setup (no, you cannot actually see my money).

I have the five Profit First bank accounts set up, and you can see them all from one dashboard in Relay (I absolutely could not handle having to log in/out for each account, or not being able to see them in one place.

My “Income” account is connected to the various credit card processors and cart softwares that actually handle my clients’ payments, so it all gets poured into one bucket.

Twice a month, I go in and distribute it to other “buckets,” with:

- 50% going to Taxes (I pay my quarterly taxes + retirement contributions out of this bucket 4x a year)

- The rest gets distributed into Expenses Out, Owner’s Comp, and Profit & Emergency (I tend to leave a chunk in here for any unexpected expenses, or use it to save for larger items I know I’ll need – like when I replaced my laptop).

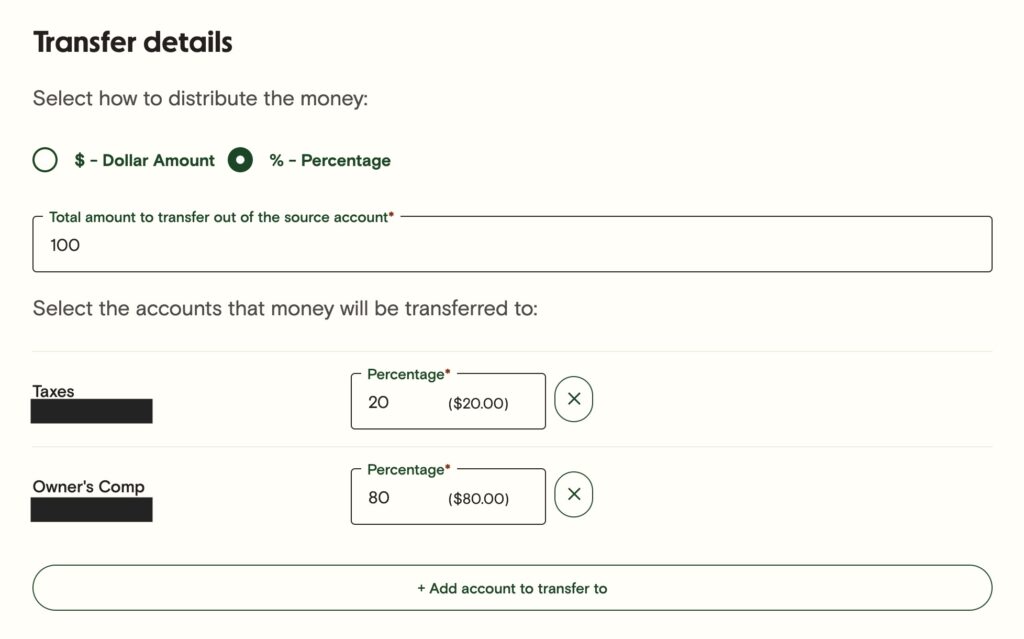

An essential feature for a Profit First bank account: transferring by percentage. This is how I move things around – you just enter where you’re transferring to/from, the total amount to move, and add quick percentages.

Relay Bank Review – Profit First Bank Account

In a nutshell, I’m obsessed with Relay.

There are minimal fees, it’s easy to organize my money, and there’s a convenient feature that lets me forward emailed receipts straight to my bank account where they’re paired with a transaction, filed, and saved for me.

Like, could it be easier?? (No, it could not)

The mobile app is easy to use, and the whole setup pairs nicely with my brain.

Plus, you can add team members to your account easily – so when I worked with Madison Dearly’s team (through the Business Bookkeeping Club) to get my finances in order, it was brainless to give them the access they needed!

For the record, I run a cash-free business and can’t speak to the pros and cons of Relay to accept cash/checks. But for an online business, I give it a five-star review.

Can you use Profit First for personal finances, too?

You already know if I can, I’m gonna – and yes, you can use Profit First for your personal finances, too! Again – I can’t stress enough how much I am NOT the girl to come to for your budget or high-level financials – but if you like organizing your money into “buckets” or separate accounts for your business, you probably like it for your personal finances too. My husband and I have and use an Ally savings account (with custom buckets set up for all of our goals) for specific savings events, like:

- Buying a new mattress

- Going on a trip

- Fun money buckets (for both of us)

- Backup funds for daycare

Want to open your own Profit First bank account with Relay?

Use this link to receive $100 just for starting and funding your account!

Relay is a financial technology company, not a bank. Banking services and FDIC insurance are provided through Thread Bank, Member FDIC. The Relay Visa® Debit Card is issued by Thread Bank pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa® debit cards are accepted.